So, there are a lot of clients who are just uninformed about insurance, especially Medicare. I was hoping that you could give us a broad overview of health insurance.

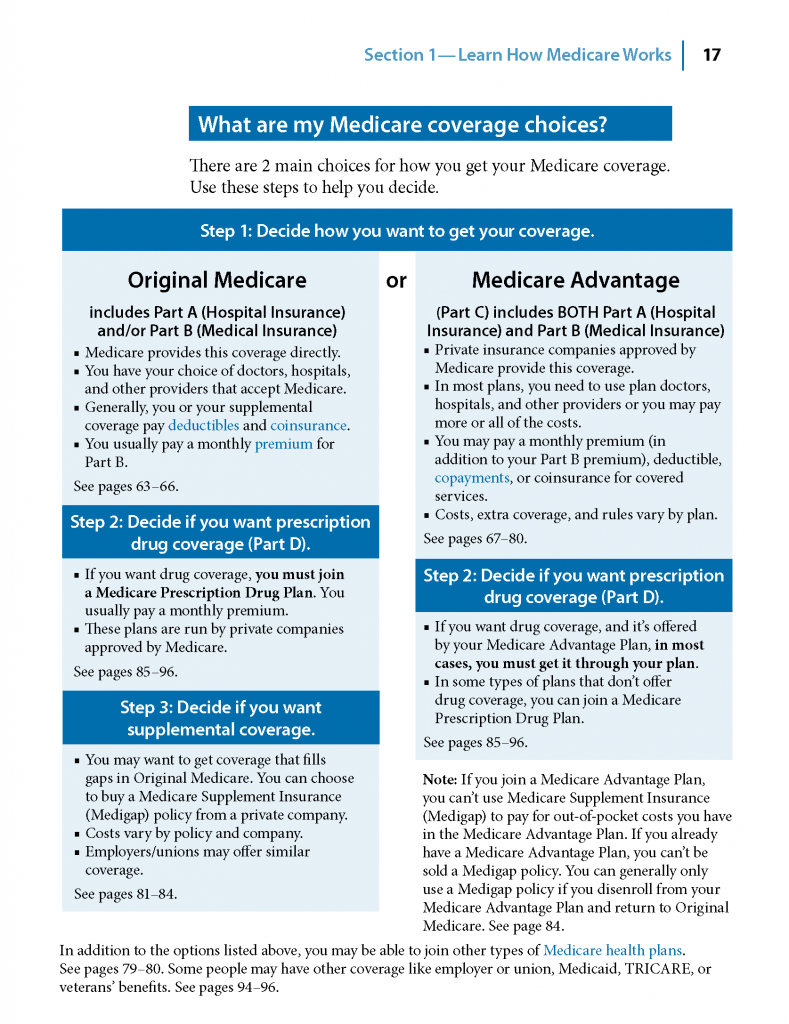

Yeah, I can help answer that question. When it comes to choosing your Medicare, many folks do have questions. I first advise consumers to find the necessary resources and educate themselves on the language of Medicare. Doing this first will help you know and understand your choices. There are several resources that people have access to and contain information on the different Medicare options. One of the great resources that I highly recommend is the 2017 Medicare and You book. For example, if you flip to page 17, it’s going to talk about the two different ways that you can receive your Medicare.

I’d recommend looking at your different options and if you go down the left side of the page, it’s going to talk about enrolling in Medicare and adding a Medicare Supplement plan to complement your original Medicare. It also explains stand-alone prescription drug plans. If you look on the right side of the page, it’s going to talk about your options, such as a Medicare Advantage plan. It’s going to look like sixty-five plans because you have to take into consideration the different types of plans like HMOs and PPOs. Plans also vary in how much the co-pay is and how much you might have out of pocket. So again, before I jump into the different types, I would say understand what your resources are so you can educate yourself on the two different ways in which you can receive your Medicare.

Dave, can you expand on what you just told us about the left and the right side and the two types of ways that people can receive their Medicare?

Dave, can you expand on what you just told us about the left and the right side and the two types of ways that people can receive their Medicare?

When I refer to the 2017 Medicare and You guide, I’m referring to the official US government handbook. On page 17, it talks about two ways in which you can get your Medicare. I refer to it as the left side of the page and the right side of the page. The left side of the page consists of finer details. When someone says, “Hey, I’ve got Medicare – the original Medicare,” I’ll talk to them about what it covers and what some of the exposures are, using the handbook. I also explain why the left side of page 17 in the handbook says, “Hey, you can get a supplement plan to cover your exposures over original Medicare.”

I also help them look at some specifics on drug plans so that’s the left side of the page. On the right side of the page, I explain to them what part C looks like and explain some of the details of having a drug plan with it embedded in that plan. More importantly, I’m really going to dig down and find out how the client operates – what their needs are on a daily basis; I’m going to do a little more fact-finding to understand my client. I want to understand their daily walk, and then I can focus on which side of the page would fit their needs and explain to them the ins and outs of both pages on both sides.

What kind of questions do you ask a client to understand them a little bit and find out what their needs are?

Based on the two different designs for getting your Medicare, you ask them how important their current doctor is to them because we need to find out whether their doctor is going to accept the plan. I’m going to find out what’s important to them as far as coverage goes. So, I check to see if their doctor is on the list. With the doctor on the list, they can receive service, and if the doctor is not on that list, then they may not receive coverage. Asking them about their doctor is an important question to ask upfront.

Next, I want to talk about their coordination of care. We want to find out what their game plan is if they have an accident. It’s important to find out what the local hospital systems look like. Let’s find out what kind of medicine they’re taking or if they want me to see how their medicine works within one of the plans. So again, I will do a very thorough needs analysis, but ultimately doctors are the most important feature of a health plan.

Got Medicare Questions?

We hope that this information on Medicare is useful to you.

Let us help you answer your questions so that you can get back to the activities that you enjoy the most.

Call (888) 446-9157, click here to get an INSTANT QUOTE, or leave a comment below!

See our other websites: