Image from Adobe Stock.

Medicare is a federal program that provides health insurance to people 65 or older, those under age 65 with certain disabilities, and people of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant). The program helps with essentials, assisting enrollees in paying for things like hospital stays, preventative exams, lab tests, and doctor’s appointments. But Medicare doesn’t cover everything! That’s why things like Medigap (otherwise known as Medicare Supplement) and Medicare Advantage (otherwise known as Part C) exist. They help widen the coverage net of a set standard Medicare policy.

Before we get too much further into Medicare add-ons though, if you’d like a refresher on Medicare basics, I highly suggest that you review this brief summary on the Centers for Medicare and Medicaid Services’ (CMS) website.

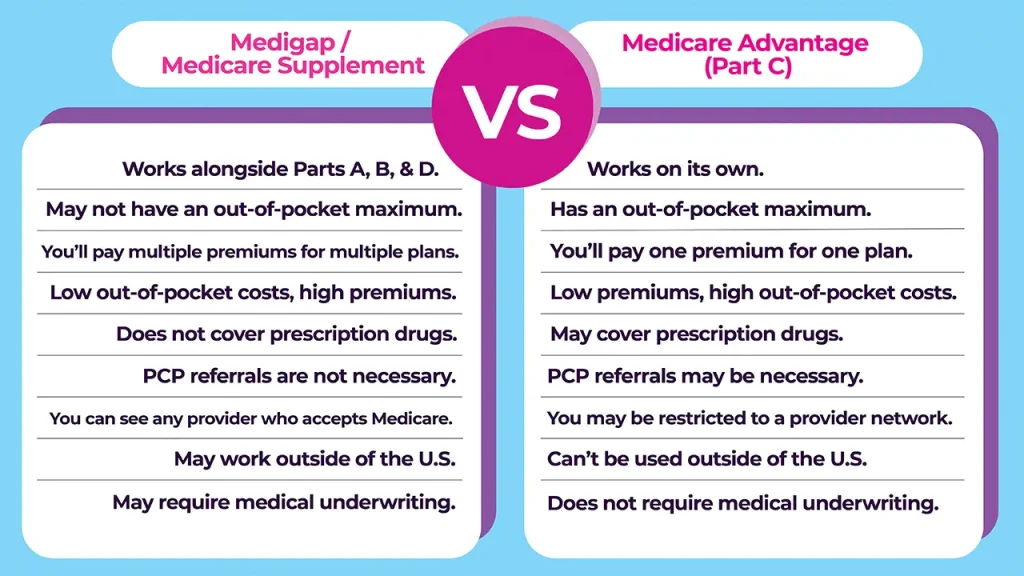

While both Medigap and Medicare Advantage serve to enhance traditional Medicare plans, they differ greatly in how they work and what they cover.

Medigap vs. Medicare Advantage

Medigap vs Medicare Advantage.

Medigap / Medicare Supplement Insurance

As its name suggests, Medigap is designed to fill in Medicare’s coverage gaps. Medigap plans work in conjunction with Medicare, so enrollees will need to sign up for both. It may be helpful to think of Medigap as an add-on or installable upgrade to Medicare.

First, let’s review some of the basic pros of having a Medigap policy…

- Medigap plans have low out-of-pocket costs. Or, in other words, they’re cheap to use. What this means is that while you may pay more every month to keep the plan active, when you get sick and need to see a physician, you won’t pay very much (if anything) for your copay, coinsurance, deductible, or any of the services you receive day-of.

- Specialist referrals aren’t necessary. You can go to any doctor, clinic, hospital, etc., that accepts Medicare, and you can go whenever you want (should they have appointments available). This benefit cuts down on the amount of time between when you notice something is wrong and when you receive treatment. It also makes choosing a doctor/facility easier.

- You’ll be covered when you travel. If you’re an adventurer and something happens to you on the road, you can still go to the doctor and expect to be covered. Even if you’re out of the country, should there be an emergency, you will likely still receive assistance. It’s nice knowing that you have backup on the road!

Some of the cons of having a Medigap policy are as follows…

- You may need to pass through underwriting. Underwriting is akin to a background check but applies specifically to your health. In order to get on certain plans, you’ll be investigated and questioned by underwriters to ensure you meet their health metrics. Pass, and you’ll be signed up for a plan, but if you fall short, your application will be denied.

- Medigap plans are not required to have out-of-pocket maximums. What this means is that there might not be a ceiling to what you’ll have to pay should a disaster strike. If you want the comfort of knowing you’ll never pay more than X dollars for your healthcare in a year (not including premiums), you’ll need to shop for a Medigap plan with an out-of-pocket maximum written into the policy’s terms.

- Medigap doesn’t cover prescriptions. If you want help paying for any prescription drugs you need or may need in the future, you’ll have to sign up for an additional supplement, or “upgrade,” known as Medicare Part D.

- You’ll be paying a lot of premiums for a lot of separate plans. To have what industry professionals and consumers alike call “excellent coverage” with Medigap, you’ll need to pay for a lot of separate plans: original Medicare (Parts A & B, both have different premiums), your Medigap plan, and a Part D (prescription drug) plan. You can opt out of getting a Part D plan—they’re not mandatory—but if you decide you want one later down the line, you’ll pay an additional fine each month along with all of your premiums. Plus, each premium can be pricey; it’s like buying single units of a product instead of buying in bulk. It’s a lot to keep track of!

Medicare Advantage / Medicare Part C

Private companies offer Medicare Advantage plans and design their plans to completely replace Medicare. They package a lot of benefits into one big policy.

The pros of Medicare Advantage include…

- It works on its own. What this means is that you don’t have to be signed up for anything else if you have a Medicare Advantage plan. It can be your one-and-only health insurance plan, and you won’t have to worry about a lot of different parts or add-ons.

- Plans will have out-of-pocket maximums. You can rest assured that there will be a ceiling on the amount you’ll pay for your healthcare in a year. So, if you take a turn for the worse, protections are in place to limit how much you can be charged.

- Monthly bills will be low. Premium payments for Medicare Advantage plans are considered more affordable than other Medicare supplements. In fact, some of them will cost you nothing month-to-month.

- Does not require underwriting. Usually, no matter what pre-existing conditions you may have, if you want to pay for a Medicare Advantage plan, your insurance application is accepted outright.

- May cover prescription drugs. Many Medicare Advantage plans have prescription drug coverage included. You won’t need to go out and purchase another supplement to see that your Walgreens or CVS visits won’t cost you a fortune.

Some of the cons of having a Medicare Advantage policy are…

- Provider network restrictions. Unlike Medigap plans, Medicare Advantage plans are tied into provider networks that will limit who you can see, when you can see them, and where you can see them. This can be inconvenient for consumers who look to receive the quick care they need.

- You may need PCP referrals to see specialists. Before you schedule an appointment with a dermatologist, cardiologist, neurologist, etc., you’ll need to schedule an appointment with your primary care physician (or PCP, a doctor that practices internal or family medicine), undergo an examination, and get a referral from them. Their referral will give you access to covered specialist visits. Without it, you’ll pay full price for any specialized care you receive.

- The policy doesn’t travel easily. If you decline in health while traveling, the full cost of seeing a doctor and getting treatment will be your responsibility. This situation can be especially tricky for people who like to explore different states or countries.

- High out-of-pocket costs. Because the premiums for most Medicare Advantage plans are low (if they cost anything at all), the costs associated with actually using the plan—your copays, coinsurance, deductible, etc.—will be high.

Medigap vs. Medicare Advantage: How To Decide Which Is Right For You

When it comes to choosing whether to enroll in a Medigap plan or a Medicare Advantage plan, it may help to ask yourself the following questions:

- What would I like my coverage to help me pay for?

- What is my monthly health insurance budget?

- Who would I like to have as my doctor?

- How far am I willing to travel to receive care?

- Do I plan on doing a lot of traveling in the future?

- Have I been diagnosed with any health conditions?

- Am I predisposed to developing any health conditions?

Ultimately, there is no one-size-fits-all Medicare solution. A lot of factors contribute to you receiving your ideal care and living a full life in good health. It’s crucial to be well-informed and understand all of your different options so you can make the right choice for you.

Got Medicare Questions?

We hope that our Medigap vs Medicare Advantage breakdown has been helpful!

Let us help you answer your questions so that you can get back to the activities that you enjoy the most.

Call (888) 446-9157, click here to get an INSTANT QUOTE, or leave a comment below!

See our other websites: