Oppenheimer in NYC

November kicked off the new collaboration between Empower Brokerage and Oppenheimer & Co. Inc. Oppenheimer is a leading global full-service brokerage and investment bank with over a century of tradition. They have a proud reputation of helping individuals, families, corporate executives, foundations and endowments, charities, pension plans, businesses, and institutions achieve their financial goals and aspirations.

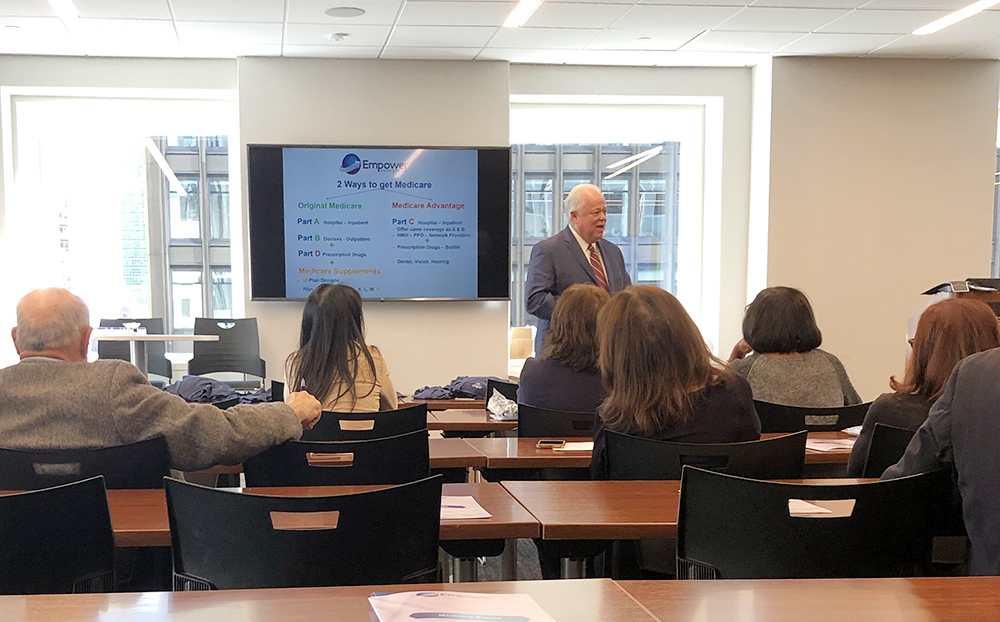

DeWayne Long, the National Sales Director at Empower Brokerage, along with John Shinn, the Senior Products Specialist, visited a large group of pre-retirement Financial Advisors in Oppenheimer’s New York City location. Launching their initiative at Oppenheimer’s impressive 30-story tower in the Financial District, Shinn and Long, provided education on transitioning to Medicare after retirement.

Empower Brokerage sent their two best representatives to meet with Oppenheimer’s senior employees so that the attendees had the best chance of receiving thorough and quality information. Between the two of them, Shinn and Long have a combined experience of over 60 years helping people make informed insurance decisions.

Suzanne Hornak Allen, Account executive, said the feedback from participants was positive and they were very appreciative of the information Empower provided. “I can’t thank you enough for your professionalism, teamwork and especially the presentation for Oppenheimer – what a great fit!”

Long and Shinn held three presentations designed to inform and educate Oppenheimer’s pre-retirement employees. Seminar topics include Medicare 101 and available options after leaving group health insurance.

Shinn says, “We are excited to serve the needs of such a professional and recognized organization. All three meetings were a success and we already have members scheduling appointments for follow-up assistance and advice on Medicare needs.”

Spanning three seminars at Oppenheimer the following topics were covered:

- What is Medicare, MAPD, PDP, and Medigap?

- What is the Annual Election Period?

- How Medicare Advantage works.

- How a Medicare Supplement works.

- An easy way to know which choices you should make.

- When you can apply for various benefits.

- The top 10 Medicare mistakes people make.

- Missed deadlines, unnecessary costs, and discounts.

John Shinn shared the two most common questions participants asked:

Question 1: I am already 65 years old. Do I need Medicare Part A or Part B if I am still working? This depends on many factors. Typically, it’s best to go ahead and sign up for Medicare Parts A and B when you age-in. Also, to maintain the guaranteed issue feature of Medicare Supplements, you should consider getting that as well. Beginning six months prior to turning 65, and continuing for six months after, Medigap carriers do not require underwriting and health assessment. If you stay on group insurance, Part A could cost you up to $1000 a month. John Shinn advises leaving your group and then sign up for Part A. This really requires a thoughtful conversation with a licensed insurance agent, like we provide at Empower Brokerage.

Question 2: I am 66 years old and ready to retire, however, my spouse is only 62 and will lose insurance if I stop working. What are my best options? If your spouse if relatively healthy a short-term plan may be the best option until they become eligible for Medicare. However, short-term plans do not cover pre-existing conditions. An ACA plan is a better option for someone with pre-existing conditions. However, if you are a high-income earner, with no dependents, expect to pay full price with zero subsidies for an ACA plan. Premiums can be as high as $1000 a month.

Oppenheimer Feedback

Based on comments from Oppenheimer and Empower Brokerage, it seems this is a great match. Both organizations seem pleased with the other because they are able to achieve their objectives together as a team. Empower Brokerage is increasingly helping large organizations, hospital systems, and municipalities with a fresh approach to customer service. We truly believe that proactivity and honest hard work are two of the keys to our success.

Got Medicare Questions?

Call Empower today and let us help you with your Medicare questions. Get an instant quote or call 1-888-446-9157